I. Introduction

NFT is a non-fungible Token. I think that many people have recently heard the word. NFT was originally a hot topic in the cryptocurrency-related industry, but recently, coupled with the news that major companies are entering the NFT business, I feel the general awareness is growing. The news of the auction in 2021 is famous as one of the reasons why NFT attracted global attention. This is an NFT work of a digital artist called “Beeple” that was not very high profile at the time on the March of the same year (“Everyday ‒ The First 5000 Days”) was valued at about 7.5 billion yen at auction.

In addition, the NFT Marketplace is a marketplace that helps artists convert digital art into NFT and provides a place for NFT transactions. It is also increasing rapidly. OpenSea, one of the major NFT marketplaces, is witnessing the expansion of the NFT-related market, with the total distribution in 2021-8 reaching about 3650 billion yen, which is more than 10 times the previous month’s growth. If you are involved as a party in a transaction involving a business that originates from such a new technology, it is essential to understand the content of that technology and its legal impact on the transaction to protect your rights and prevent disputes in advance. In this paper, we outline the significance of NFT and the technology that is the source of its value, and examine the legal issues related to NFT, especially matters to be considered in formulating rules for NFT transactions related to digital art.

II. Features and mechanisms of NFT

1. Features of NFT

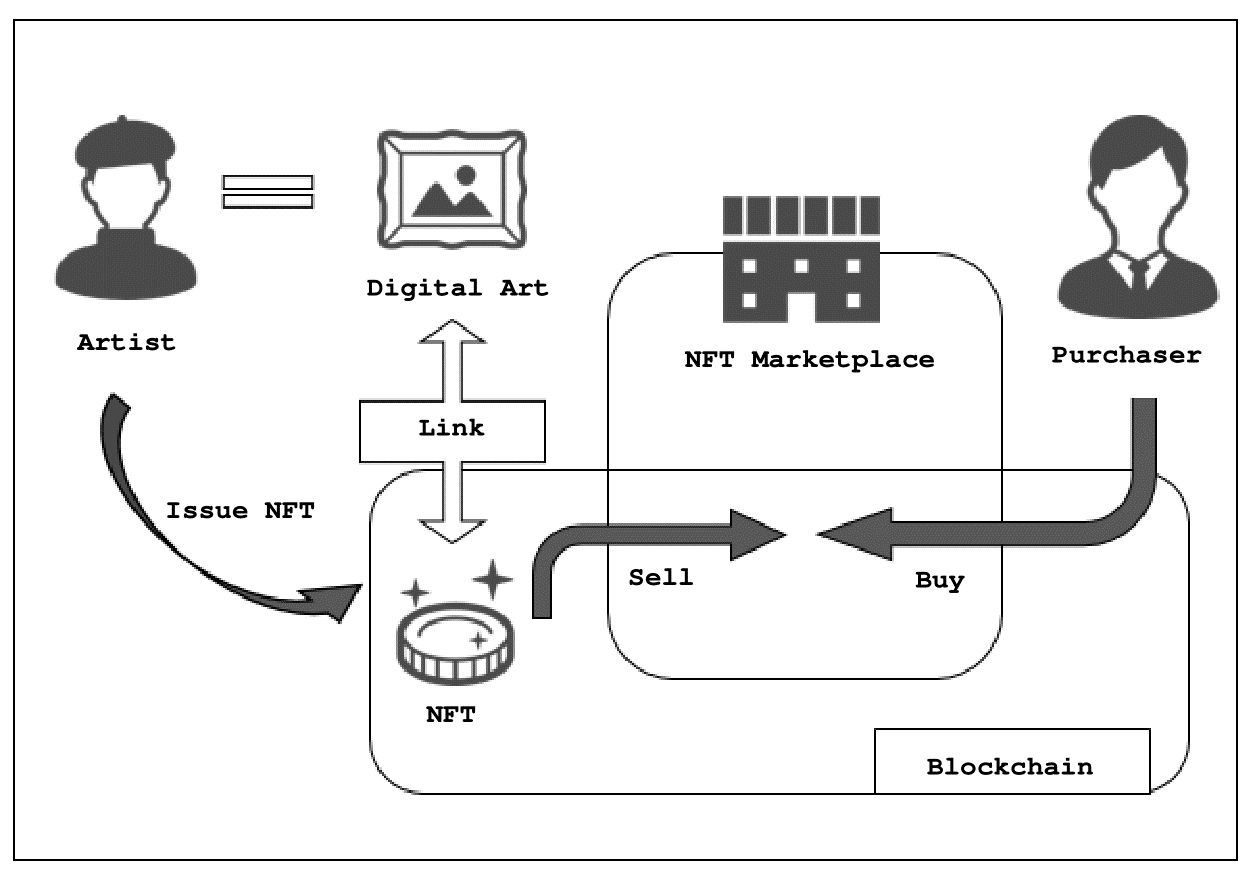

Before we outline the features and technical aspects of NFT, we will explain NFT transactions on the NFT marketplace using diagrams to give an image of what NFT is like.

First, digital art artists can apply specific blockchain standards (e.g. ERC-721 in Ethereum blockchain) and issue a token with a unique ID in compliance with this policy. In this way, tokens that have their own unique value and do not have an alternative to other tokens are called NFT. When publishing this NFT, artists can link the NFT to the digital art they have created. This is sometimes called the “NFTize” of digital art. It is now possible to prove that it is the original through the possession of NFT.

Artists can sell NFT linked to digital art in the NFT marketplace as described above. Users of the marketplace can find and purchase this NFT, and the transaction history at this time will be recorded on the blockchain. In this way, NFT is a landmark technology in that it gives scarcity and asset value to digital art, which was previously easily reproducible.

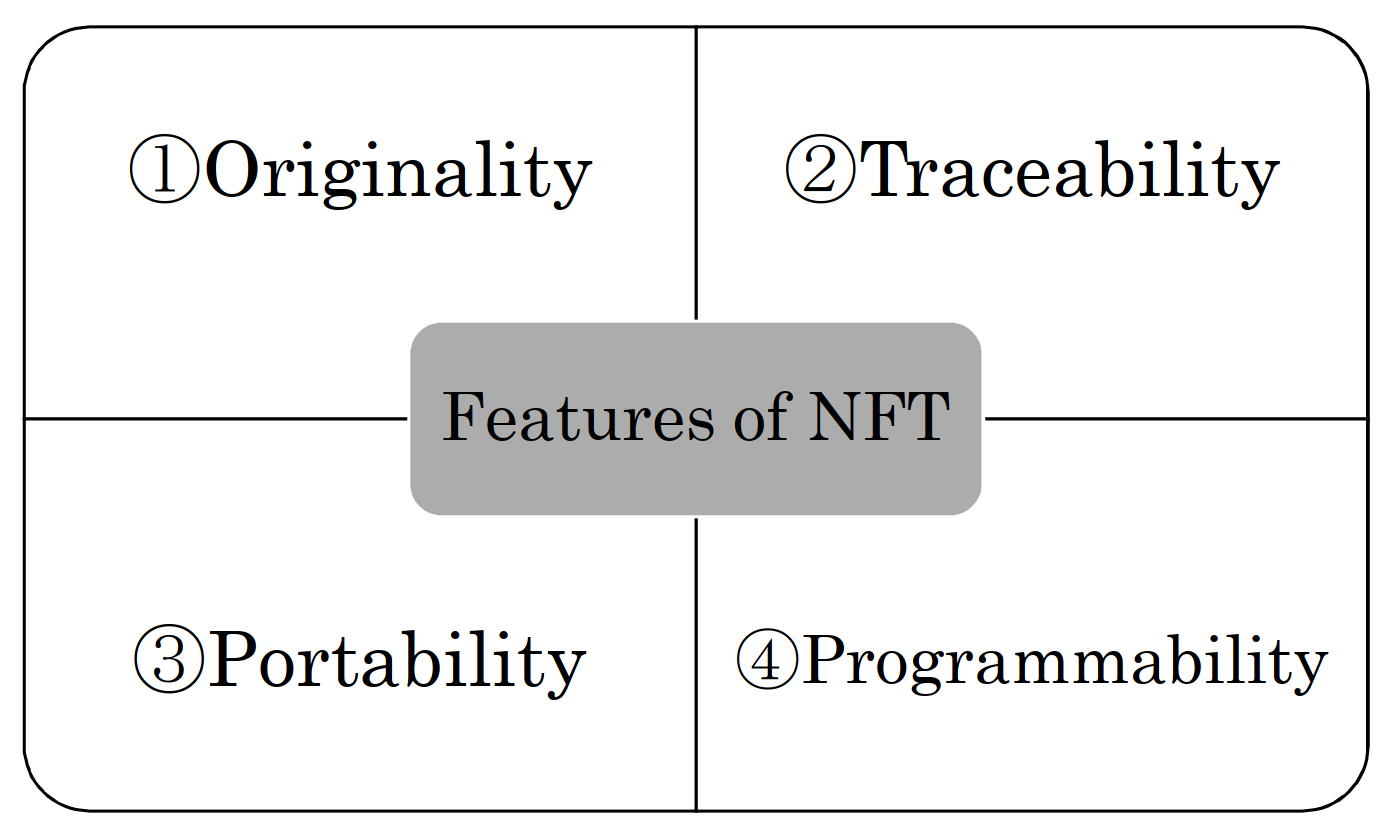

The above is an example of how to use NFT in relation to digital art, but NFT generally has the following characteristics.

Originality is unique in that NFT itself has a unique value and there are no other tokens. This unique value is recorded on the blockchain, and its tampering is very difficult, so it can be said that this uniqueness is highly reliable. By using this, we can add rarity to content linked to NFT, and we can say that we have a high affinity with markets where the rarity of goods is important for value-added, such as art, trading cards, fashion or music.

Traceability is a feature that focuses on NFT holder information. At the same time as the NFT is issued, the holder is recorded on the blockchain, and all subsequent transactions are also recorded on the blockchain. Thus, the buyer can trust the seller to be the current holder of the NFT (and, consequently, the content associated with it), and can trade with peace of mind. It can be said that the characteristic with meaning in the market where “who owns” has an important meaning for commodity value.

Portability is one of the features of NFT. This is a feature of NFT’s distributivity. For example, in the past, digital items purchased in a certain game could, in principle, be used only in the relevant game. However, since the data held by NFT is recorded on a blockchain that does not belong to any game, it has the potential to realize the use of NFT items purchased in one game in another game.

In addition, NFT can set various trading conditions in advance using the mechanism called smart contract. This is the programmability of NFT. Smart contracts are “programs that store contracts written in programming language or machine language on the blockchain, verify the validity of the contract mechanically by the participants of the system, and automatically execute the contract.” Ethereum, a representative blockchain where NFT is issued, has also a smart contract. With this smart contract, artists can achieve returns similar to resale right adopted in the EU. Resale right refers to the right of the author to receive a portion of the transaction amount when the work is resold to a third party, and this is a system that is not currently recognized under Japanese copyright law. However, by setting the condition on the smart contract at the time of NFT issuance, “I as the issuer receive 5% of the purchase price each time NFT is bought and sold”, it becomes possible to receive revenue return like the resale right.

2. Mechanism of NFT

The innovative feature of NFT lies in its unique nature, but what kind of technology is this unique feature secured? It is useful to review the technical aspects of NFT when considering legal issues related to NFT transactions, which will be discussed below, and I will outline it here.

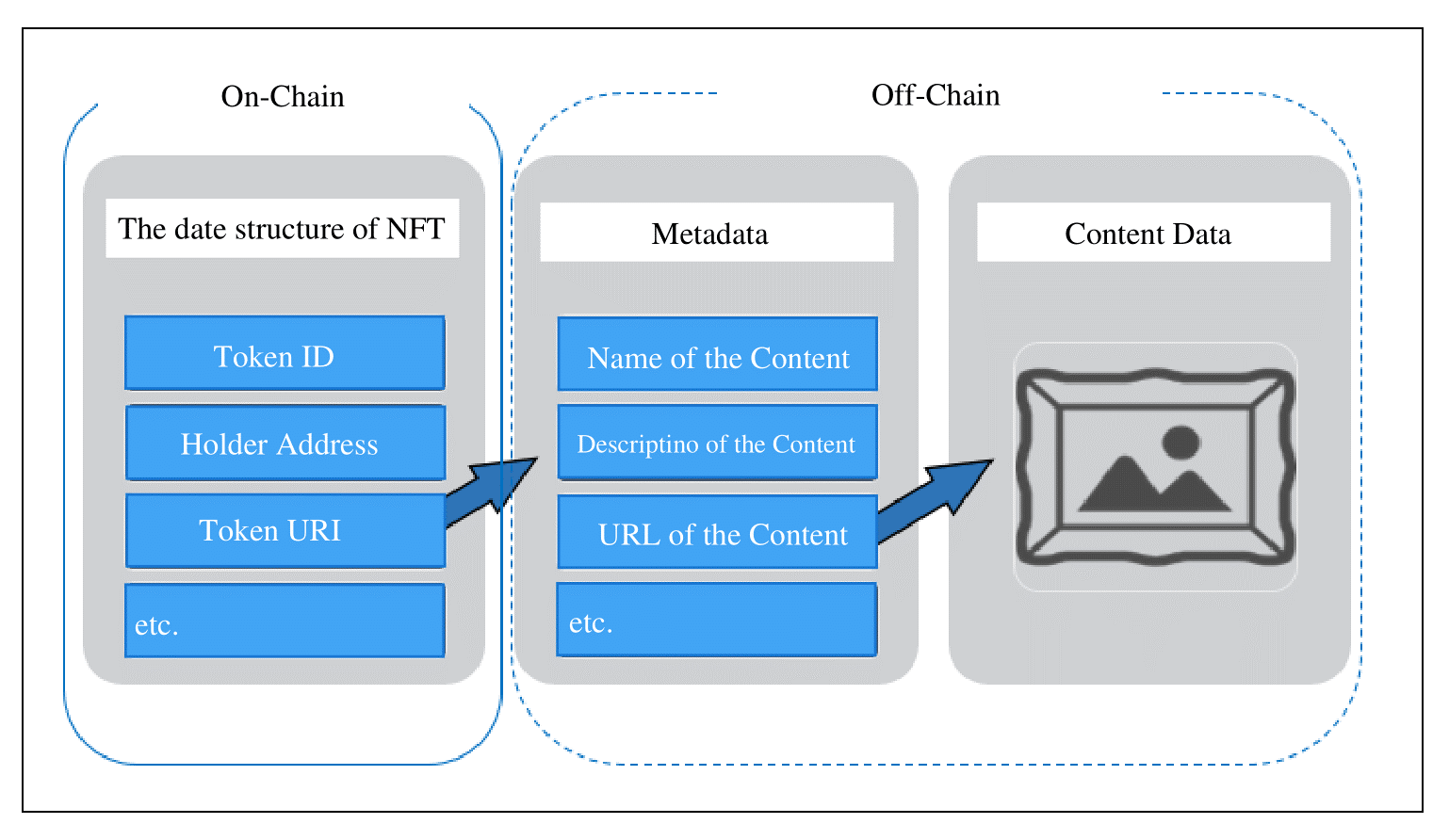

As mentioned earlier, Ethereum is a typical blockchain that can issue NFT, but Ethereum has a token standard called ERC (Ethereum Request for Comments), and ERC-721 is often used as the issuing standard for NFT. The data structure of the NFT issued based on ERC-721 is shown in the following figure, and information such as token ID, holder address, token URI (Uniform Resource Identifier) is recorded on the blockchain. This token ID is a unique value that makes the token unique, and this is how the irreplacability of the token is guaranteed. A token URI is an attribute that indicates the location of content information (metadata) associated with an NFT. As metadata, the name of the content, description, URL of the data (Uniform Resource Locator), etc. can be described.

The token URI recorded on the blockchain as NTF indicates the location of the metadata, and the URL of the content data in the metadata indicates the location of the content data, and the content data is tied to the NFT.It should be noted that since the data size that can be recorded on the blockchain is not large, metadata and content data itself are mostly managed outside the blockchain (off-chain).

III. Legal Issues Related to NFT Transactions

1. Organizing Concepts

Based on the above understanding, we will consider the legal issues related to the transaction of NFT linked to digital art below. Specifically, as a prerequisite for consideration, we will arrange related concepts legally, and explain the matters to be considered in the formulation of rules for NFT transactions linked to digital art. Therefore, in this section, we will first sort out the concepts related to the above transactions.

First, the term “NFT digital art” in the following refers to digital art that is linked to NFT and managed outside the blockchain. Since only tangible objects are subject to ownership under civil law, NFT digital art, which is data, is not subject to legal ownership. However, if it is “a creative expression of thought or emotion” (Article 2, Paragraph 1, Item 1 of the Copyright Act), the NFT digital art will become a work and the creator will be entitled to a copyright. In the event of copyright infringement, the creator of the digital art can claim the injunction of the infringement and compensation for the damage suffered from the person who infringes the copyright. The creator may also grant permission to third parties to use NFT Digital Art.

On the other hand, when simply referred to as “NFT” in the following, it refers to the token itself as data recorded on the blockchain. The content of NFT data usually does not itself contain content data, so NFT digital art associated with NFT is separate data from NFT.

While NFT and NFT digital art are sometimes confused and explained, it is important to distinguish between the two concepts when considering what is the subject of the transaction and what legal rights the buyer can acquire in the transaction related to NFT.

2. Legal perspectives to consider when developing rules for transactions related to NFT Digital Art

(1) Importance of NFT Marketplace Terms of Use

Transactions relating to NFT are rarely made only by both the holder and buyer of NFT, and it is common to be made through the NFT marketplace, which provides a place for the issuance and sale of NFT. In the case of transactions using new technologies such as NFT, there is a possibility that the protection of the rights of the parties may be insufficient due to the lack of legal maintenance, and in such cases, it is desirable to establish appropriate trading norms through arrangements based on the agreement between the parties. It is expected that the Terms of Use of NFT marketplace will play that role. It is also important for the NFT Marketplace to develop rules that fairly protect the rights of the parties through the Terms of Use, in that they can increase the incentive and use of NFT listings and purchases in that marketplace.

Therefore, in the following, from the viewpoint of protecting the rights of copyright holders of NFT digital art and purchasers of NFT issued by copyright holders, we will examine the unique problems in transactions related to NFT digital art and explain the matters to be considered in the rule formulation (assuming that it is based on the Terms of Use of NFT Marketplace) to address these problems.

(2) The perspective of protecting the rights of NFT purchasers

(i) Problems inherent in NFT transactions

First, NFT transaction-specific issues related to the rights of the person who purchased the NFT can be considered as follows:

Buyers in the NFT marketplace will consider purchasing an NFT in the hope that they will gain a position as if they “own” the NFT digital art associated with the NFT through their ownership of the NFT. However, as mentioned above, NFT digital art is not subject to ownership, so holding NFT will not legally own NFT digital art. In addition, since the data is separate from NFT and NFT digital Art, even if the buyer of NFT receives the transfer of NFT, it does not acquire copyright, which is a legal right about NFT digital Art, and it is only possible to acquire the right to use NFT digital Art if there is an agreement on a license between the parties. In this way, the gap between what NFT buyers expect from NFT holdings and what legal status they can actually acquire is considered to be one of the inherent problems in transactions related to NFT (The First Problem).

In addition, an artist may convert one digital art into an NFT and sell it to a third party on the NFT Marketplace, and then convert the same digital art into an NFT again on the marketplace or another NFT marketplace. Since there are no technical restrictions on the number of times the same digital art is converted to NFT, there is a possibility that the value of the right to use NFT or NFT digital art of NFT buyers may be diluted after the fact (The Second Problem).

Furthermore, as mentioned above, since NFT and NFT digital art are managed in different locations, it can be said that the outcome of both data does not coincide is a problem inherent in NFT transactions. In other words, after the NFT purchase, only the NFT digital art associated with the NFT may disappear, or the server to which the NFT digital Art is stored may terminate the service and the NFT purchaser may no longer be able to access the NFT digital art (The Third Problem).

(ii) Matters to be considered in the formulation of rules

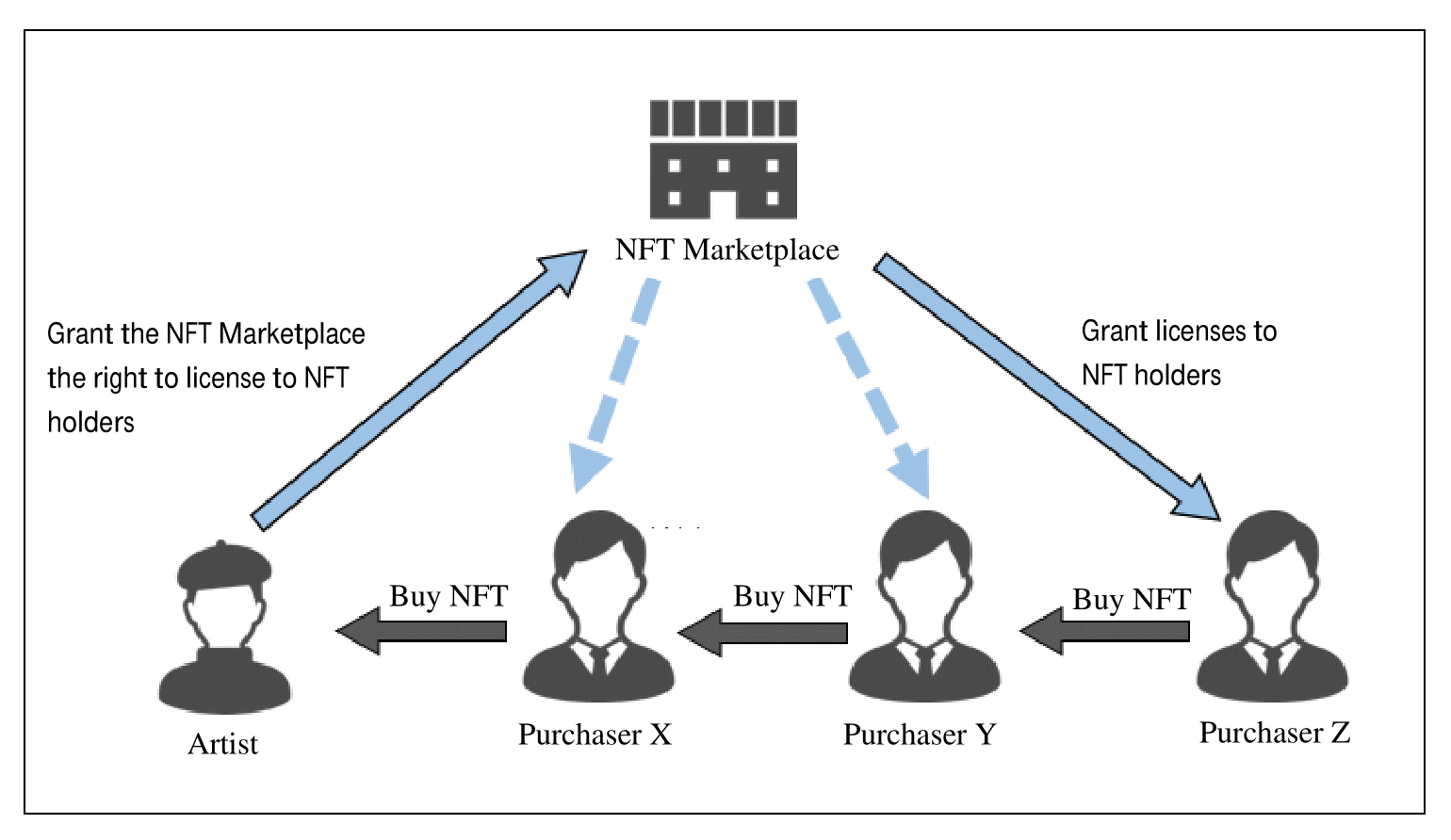

In terms of the First Problem, as a means to reduce the above gap, it is possible to use the licensing of the art by the copyright holder of the NFT digital art to the purchaser of the NFT. The license by the copyright owner gives NFT purchasers the legal right to use NFT digital art, which means that the NFT purchaser’s purpose of having legal rights in NFT digital art is fulfilled to a certain extent. As a method of licensing to NFT purchasers, as shown in the figure below, the copyright holder grants the NFT Marketplace “the right to license NFT digital art to NFT holders” at the same time as the NFT exhibition, and the NFT Marketplace grants licenses to NFT holders in accordance with the transfer of NFT.

This design eliminates the need for each NFT buyer to obtain consent from the copyright owner each time they acquire an NFT, and ensures predictability because the content of the right to use is described in the Terms of Use.

In the above case, if the copyright owner transfers the copyright to a third party after the NFT listing, the outcome of the right to use of the NFT holder becomes a problem. The Copyright Law stipulates that even if the copyright owner transfers the copyright after licensing the copyright to the user, the user can oppose the right to use against the assignee of the copyright (Article 63-2 of the Copyright Law).The Act is also considered to apply to the rights of use acquired by the Sublicensee. Thus, even if the copyright owner transfers the copyright to a third party “after” the NFT Marketplace sub-licenses the NFT holder, the NFT holder can counter the right to use the NFT digital Art against the assignee of the copyright. However, if the copyright is transferred “before” the NFT Marketplace sub-licenses to the NFT holder, the act does not apply, so the NFT holder may not be able to use the right against the assignee of the copyright and may not be able to use it as expected. Therefore, in order to prevent such a situation and protect the rights of NFT holders, it is also a matter to consider that the Terms of Use prohibit the transfer of copyright by the copyright holder after NFT listing.

Next, with regard to the Second Problem, if NFT issuers are able to change the number of NFT issuance after the fact, which NFT purchasers expected at the time of purchase, the scarcity value of NFT will decrease and NFT purchasers may suffer unforeseen disadvantages. Therefore, in the Terms of Use, the number of NFT issuance is decided in advance at the time of issuance of the NFT, and it is possible to establish a provision that prohibits the issuance of more NFT in any NFT marketplace. However, even with such a provision, it may be difficult to establish a causal relationship between the issuance of an NFT exceeding the specified number of issuance and the decrease in the value of the purchased NFT, and it is important to note that a claim for damages against an NFT issuer is not necessarily a valid remedy.

Regarding the Third Problem, it is not realistic to have these parties express and guarantee that NFT digital Art is stored in a location referenced by NFT, as artists and the NFT marketplace do not necessarily have sufficient authority for the management of NFT digital Art. It is considered that it is difficult to take effective measures based on the Terms of Use regarding the risk that NFT purchasers will not be able to access the digital art associated with the NFT after purchasing the NFT. For example, the development of a blockchain that can record information of a large capacity (by this, NFT digital art itself is recorded on the blockchain) is expected to be solved from the technical side.

(3) Viewpoint of protection of rights of copyright holders

(i) Problems inherent in NFT transactions

Next, we look at issues specific to NFT transactions related to the rights of authors to issue NFT.

Originally, digital art had a problem that it could be easily accessed by third parties other than the copyright holder due to the characteristics of taking the form of data. NFT can be the beginning of giving digital art a unique and asset value, but it should be noted that the above problems still remain. That is, there is a problem that a third party who is not a copyright owner can convert NFT digital art into NFT without permission from the copyright owner (The Fourth Problem).

In addition, as mentioned above, copyright holders can use smart contracts to receive profit returns similar to retroactive rights. However, at present, each NFT marketplace uses a smart contract of its own specifications, and the copyright owner relies on this to set the profit return, so the program related to the profit return may not be activated in other NFT marketplaces or relative transactions (The Fifth Problem).

(ii) Matters to be considered in the formulation of rules

As for the Fourth Problem, as a copyright owner, I think that we will consider whether it is possible to claim copyright infringement when NFT is issued by an unauthorized person. However, as mentioned above, the NFTization of digital art itself is only a data connection between non-replaceable tokens and digital art, so it is likely not to fall under the category of copyright infringement. In reality, however, it is considered difficult to sell the NFT without displaying digital art associated with the NFT on the NFT marketplace, so it is possible to claim infringement of copyright such as reproduction rights and public transmission rights at the time of such display. As an NFT marketplace, in order to prevent disputes based on NFT issuance by unauthorized persons, it is possible to prohibit the issuance of NFT by persons who are not copyright holders in the Terms of Use. In addition, it is also effective to request the upload of NFT digital art at the time of NFT issuance, in order to make the copyright owner aware of the fact of copyright infringement early in the event of NFT issuance by unauthorized persons.

In terms of the Fifth Problem, as a prerequisite for discussion, there is a question of whether the program described in the smart contract will form the content of agreement between the parties to the transaction. In this regard, “Infrastructure development according to the data・driven society in Japan 2017 (survey on technology and systems corresponding to distributed systems)” report states as follows.

“It is considered necessary for the contracting parties to recognize the basic mechanism that contracts described in machine language is automatically made based on certain instructions from the parties and to agree to use of smart contracts in advance. It is not necessary to give explicit consent to the results of the operation again, but it is required to make a common understanding of society, which is the basis for the conclusion of the agreement, through the explanation of the service, the terms and contracts for the use of the system, and the common understanding of society.”

Based on this idea, when NFT marketplaces implement their own smart contracts, we believe it is important to familiarize them with the use and implementation mechanism in the Terms of Use.

Next, regarding the implementation of the profit reduction system, from the viewpoint of protecting the rights of copyright holders, it is desirable to introduce a profit reduction system of common standards between NFT marketplaces. However, as an NFT marketplace, it is natural to want to adopt a unique profit reduction system to give trading incentives in their own marketplace, and in this case, it can be said that the interests of the NFT marketplace and the copyright owner are conflicting, so it may not be realistic to expect NFT marketplaces to voluntarily adopt a common profit reduction system with each other. In view of the fact that it has become easier to supplement art transactions with the advent of new technology called NFT, there is a legislative approach in Japan that allows the right to follow-up under copyright law. Alternatively, a standard on the blockchain that has a profit reduction system mechanism is developed in advance, and this will become the de facto standard for the entire industry, thereby realizing a profit reduction system that goes beyond the NFT marketplaces.

IV. Finally

As mentioned above, in particular, from the viewpoint of protecting the rights of NFT purchasers and copyright holders, we considered the problems inherent in NFT transactions related to digital art, and explained the matters to be considered in creating rules to respond to these problems. There are a wide range of other matters to be considered in the formulation of rules for NFT transactions, including the responsibility of the NFT Marketplace itself and the prevention of fraud such as money laundering. We hope that this article will help those who may be involved as a party in NFT transactions to conduct legal examination of such transactions in the future.

Written by Kei Teshirogi

Oh-Ebashi LPC & Partners

DISCLAIMER

The contents of this article are intended to provide general information only, based on data available as of the date of writing. They are not offered as advice on any particular matter, whether legal or otherwise, and should not be taken as such. The author and Oh-Ebashi LPC & Partners expressly disclaim all liability to any person in respect of the consequences of anything done or omitted to be done wholly or partly in reliance upon the whole or any part of the contents of this article. No reader should act or refrain from acting on the basis of any matter contained in this article without seeking specific professional advice.